Proposed changes to rates of capital gains tax in the UK could well provide another reason to consider relocating to Guernsey.

UK Chancellor Rishi Sunak recently commissioned a report which recommends a major overhaul of capital gains tax or CGT. The report highlights measures that could raise up to £14bn in additional taxes and plug a hole in the UK government’s finances as a result of the impact of the Covid pandemic.

Described as a ‘tax squeeze on the well-off’ by some commentators, the main losers would be wealthy people who own second homes or assets not shielded from tax.

David Parrott, associate director at LTS Tax Limited, confirmed that some of the recommendations within the review include:

- Aligning CGT and Income Tax rates

The top rate of CGT for most transactions is presently 20% with an additional 8% charge for disposals of residential property and carried interest receipts. Aligning CGT and Income Tax rates could increase CGT rates to 45%

- Reducing or abolishing the CGT Annual Exemption (AE)

The AE presently stands at £12,300. Reducing the AE could have the effect of doubling the number of people who pay CGT each year

- Further reduction to, or removal of, Business Asset Disposal Relief (BADR) (formerly Entrepreneurs Relief (ER))

BADR presently allows disposals of qualifying assets to be taxed at a rate of 10% (rather than 20%) up to a lifetime limit of £1M (previously £10M under ER)

- Removal of the automatic CGT uplift for assets held at death

Assets received by beneficiaries on death presently benefit from a CGT uplift to the market value as at that date instead of receiving the asset as its original cost, which can result in significant CGT savings for the beneficiary. The report recommends that consideration should be given to removing this relief

‘Guernsey residents are generally not subject to CGT, other than on the disposal of UK land or property,’ said David.

‘Gains realised upon the sale of shares in UK registered companies, for example, should not be subject to CGT in the hands of Guernsey residents. For disposals of UK land or property by Guernsey residents, it is possible to re-base the asset for CGT purposes to its value at 5 April 2015 for residential property and 5 April 2019 for other UK land and property.

‘Consequently, by relocating to Guernsey, and with appropriate tax advice, it should be possible to either avoid the charge to CGT in its entirety or at least reduce any CGT arising upon the sale of UK land or property,’ said David.

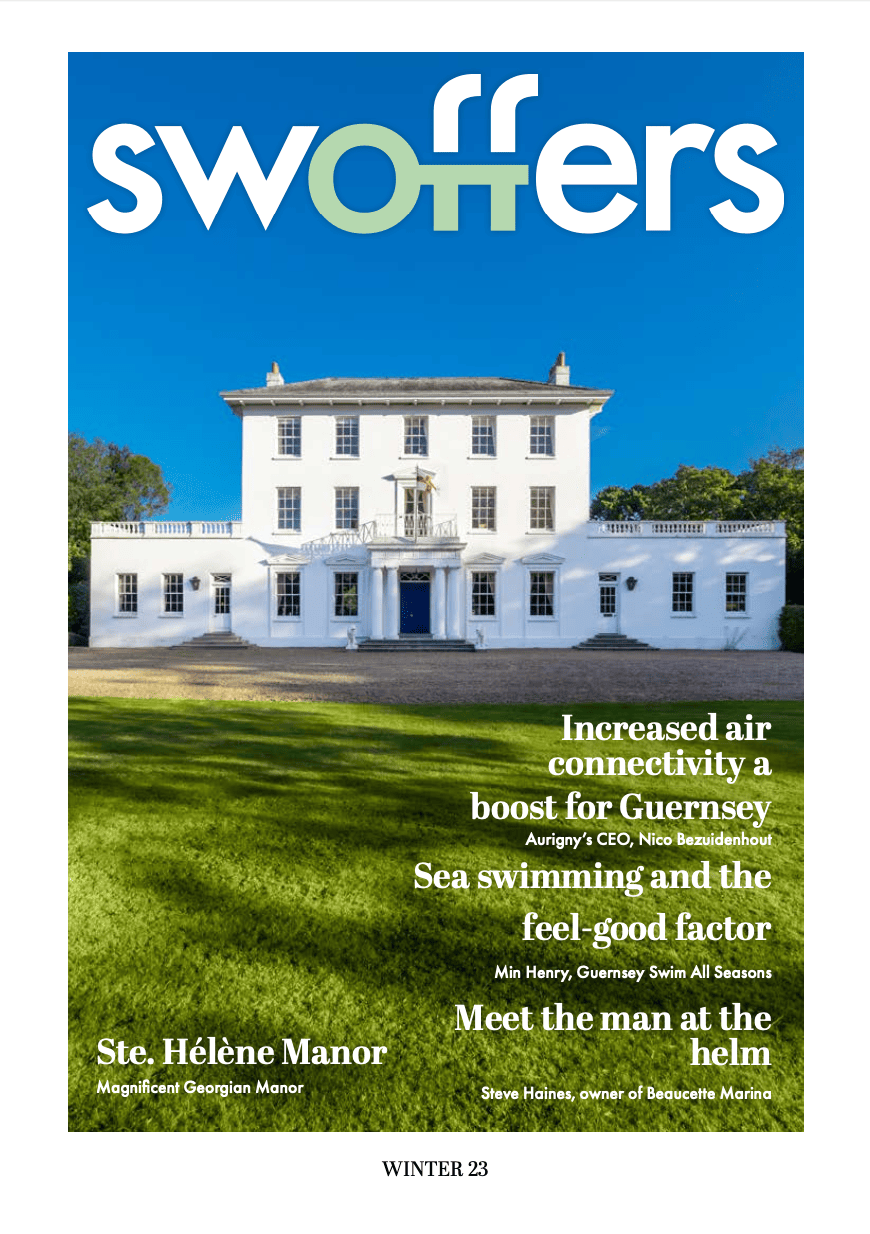

Swoffers is the market leader in open market sales, and despite the impact of Covid overall sales in 2020 are on a par with 2019, and may even exceed them by the end of the year.

‘We have definitely seen an increase in new clients enquiring about relocating to Guernsey,’ said managing director, Craig Whitman.

‘As a self-governing jurisdiction, the island has developed its own favourable system of taxation and, in comparison with many other jurisdictions, tax in Guernsey is straightforward.

‘But there are many more reasons why people are exploring the option of moving here. Guernsey is safe and secure, the island offers a great work/life balance and high quality lifestyle plus there are no barriers to entry,’ said Craig.

‘We have a wide range of open market properties for sale or rent, including a number of low profile confidential instructions so anyone interested in making the move should speak to one of the experienced Swoffers team.’

You can contact the open market team on 01481 711766 or email sales@swoffers.co.uk

Note: The team at LTS Tax are experienced in assisting those that wish to relocate to Guernsey and are well equipped to advise on available tax planning opportunities. Please contact David Parrott or your usual contact at LTS for further information