Guernsey’s dual property market is unique. The Open Market offers property investment opportunities and enables EU nationals looking to move to the island a chance to buy or rent in the island.

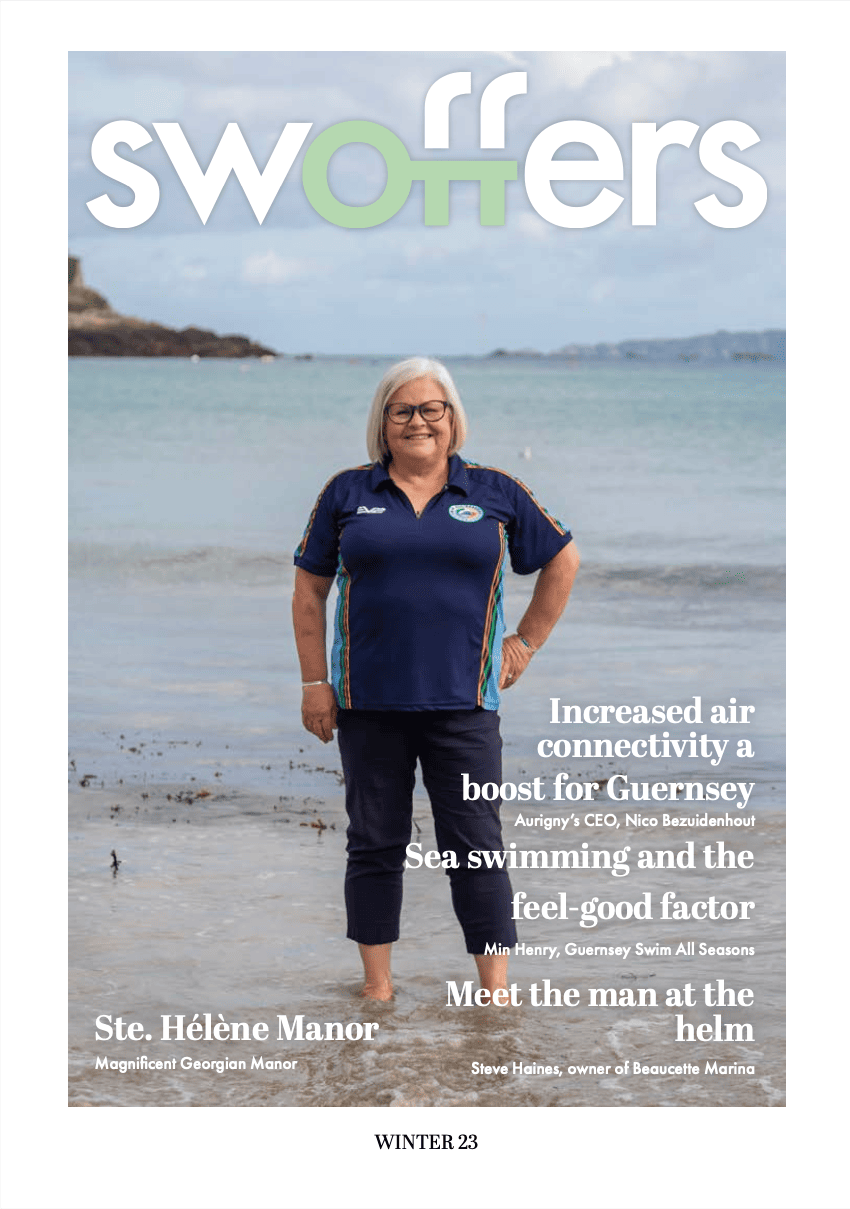

Swoffers has unrivalled experience and knowledge of Open Market property in Guernsey and Shauna Clapham knows the market inside out.

Swoffers is Guernsey’s go-to agent for Open Market properties, our clients rely on us for local insight.

We’ve shared some of those insights in this question and answer session with Shauna.

Much has been said about the Open Market recently, can you tell us what has happened this year?

Shauna: I think it has been well documented that the beginning of the year was slow. However, since May the market has definitely been busier. We believe that activity will convert into more completions over the coming months. We’ve also been busy with viewings from visiting buyers which is also encouraging.

The Guernsey Press said recently that there had been only seven Open Market sales so far in 2016.

Shauna: Yes that is true but, as I always say to vendors, it is dangerous to take one quarter in isolation.

We have had Brexit looming for the first half of this year and, whether we like it or not,Guernsey is not isolated from whatever is affecting the UK.

Being nimble is the key. Reacting quickly to offers because sales are often still price sensitive and we’ve got to remember that the buyer still has a lot of choice.

Is it fair to say the sales published this year are not a reflection of the Guernsey Open Market as you see it?

Shauna: I would agree with that statement.‘Things have picked up considerably since the beginning of the year and Guernsey seems to be attracting a little bit more interest. I think people are now realising that there are going to be big changes in the UK and it’s time to start exploring plan B.

So, with the recent Open Market sales you’ve mentioned there has been interest from people off island. What do you think is sparking that activity?

Shauna: That’s a really interesting question. What we have found this year is that a lot of the people who are considering a move to Guernsey are doing so after a recommendation from a friend or colleague.

It seems that those who have made the move already are keen to share the advantages – both from an environment and lifestyle perspective and also from a tax point of view. I think it is the same old story with Guernsey, we are not very good at shouting about what we do and we should be proud of some of the initiatives that we can offer to high net worth individuals.

Our tax system is still so very simple and the key to that is there are no requirements for entry. Guernsey’s whole system is just so straightforward. Simplicity, safety and stability are the three key words that people want to hear. If you hear that from a peer or from a tax adviser then I think people will listen and come and have a look.

Historically there has been perhaps a perception that Guernsey Open Market property prices have been very high. How do you see that now in the context of the UK and London in particular?

Shauna: London is still in a league of its own. Interestingly, I did a bit of a survey with a London agent recently, they are familiar with both London and Guernsey and we looked at how local properties compared to properties in comparable areas of London and I think Guernsey compares really well.

Guernsey has always been expensive but spend over two million pounds in the UK and you are paying 12% stamp duty; we are still at 3% document duty, we have no council tax and our household rates are low, so looking at the whole package then Guernsey is a good option in lots of areas.

Sounds like Guernsey is actually looking fairly good value at the moment. There have been some good properties, town houses for example, that sold under one million pounds and if you benchmark that against London or even second homes in Cornwall, is it fair to say Guernsey is looking pretty good value for money?

Shauna: Yes, I think it is. I’ve had almost 30years’ experience as an agent and I think there are some really good deals to be had right now. If I were in the fortunate position of looking for an Open Market property, I’d be buying!

So yes, there are opportunities and I think it is an interesting time for Guernsey – we could well benefit from the uncertainty that surrounds the UK right now.

I am hearing a lot of positive messages from people here on the island, they are seeing those opportunities as well, so we just need to get that message out there.

Let’s not forget that if you live in Sussex or London and you’ve got a holiday home in Cornwall it will take you five hours to get there whilst you can get to Guernsey, door to door, in less time.

What about Brexit? What in your view are the implications of Brexit for the property market in Guernsey?

Shauna: Gosh that’s a big question! I think it could go either way, I think Guernsey now has to put a stake firmly in the ground stating who we are and what we do well.

We need to remind business and investors that Guernsey is a safe, stable home. We are not in the EU and I realise we still have to negotiate our new relationship with the EU, but I think we maybe make a little more noise about our links and the way we’ve always survived and flourished.

I believe Guernsey could provide an option for people who are a bit disillusioned with the UK and Europe. Interestingly, since Brexit we’ve had enquiries from the continent at a level we do not usually experience, now whether those come to anything is another story, but it is interesting and we’ll report back on how that develops in the months to come.

The UK Chancellor is just about to announce a reduction in corporation tax in the UK to 15% and of course in Guernsey it is 0%, an opportunity for Guernsey:

Shauna: Yes, all these things are opportunities for Guernsey and this is what I was saying earlier, we have some fantastic tax advantages which we should be proud of and which we should be talking about. Whether the UK does go with 15% corporation tax remains to be seen.

We need to look as though we are solid, talking as one about the advantages of living in Guernsey, whether that be corporation tax or 20% income tax or the fact that our lifestyle is second to none, with us having more time to enjoy our lives and our leisure time; these are all big messages.

Locate Guernsey was established at the beginning of the year, how have you found working with their team?

Shauna: We are absolutely delighted to have an organisation focused on attracting new talent and business to the island. Locate Guernsey has a huge remit. I think Richard and his team are doing incredibly well because they have had to hit the ground running and become very familiar with all aspects of encouraging businesses and individuals to the island. In the next 12 months I expect to see a much more constructive programme of events and we have said all along that we are happy to support them in whatever way we can.

Use five words to sum up why someone should consider moving to Guernsey:

Shauna: That is easy – safety, security, beauty, low tax and happiness!